-

Who Qualifies for the EV Tax Credit in 2023 and Beyond?

- January 13, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

No Comments

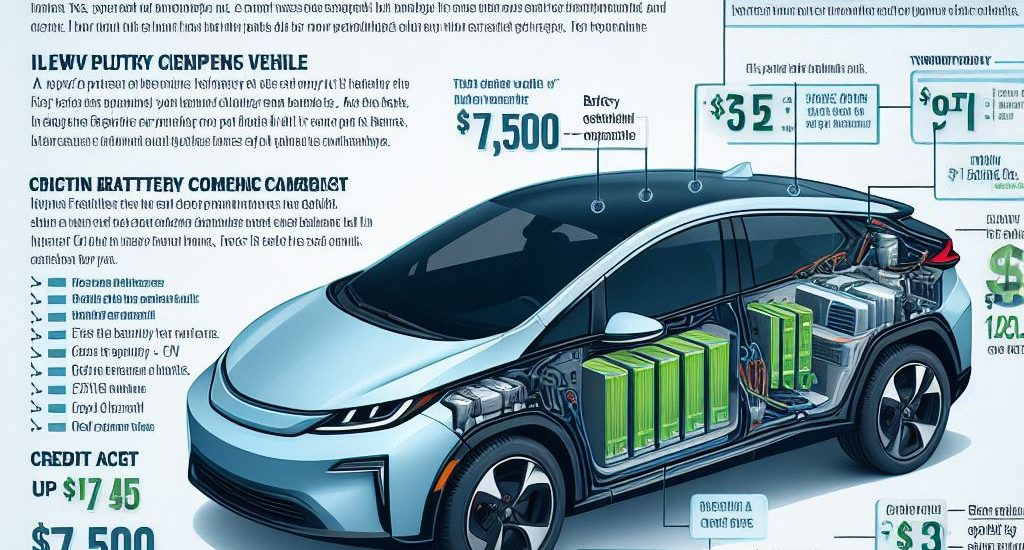

The EV tax credit is a federal incentive that offers up to $7,500 for buying a new, qualified plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after. The credit is nonrefundable, which means it can only reduce your tax liability and not give you a refund. The credit amount depends on the battery capacity, the date of delivery, and the critical mineral and battery component requirements of the vehicle. The credit is also subject to income limits and phase-out rules based on your modified adjusted gross income (AGI) and the manufacturer’s sales volume. To claim the credit, you need to file Form 8936 with your tax return and attach the information provided by the seller at the time of sale

-

EV Tax Credit: How to Claim Up to $7,500 for Buying a New Clean Vehicle in 2023 or After

- January 12, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

The IRS offers a clean vehicle tax credit of up to $7,500 for buying a new, qualified plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after. The credit amount depends on the battery capacity, the date of delivery, and the critical mineral and battery component requirements of the vehicle. The credit is also subject to income limits and phase-out rules. To claim the credit, you need to file Form 8936 with your tax return and attach the information provided by the seller at the time of sale.

We are professional Tax preparers. We prepare individual and business tax return. We help our client with Unemployment related questions and concerns.