-

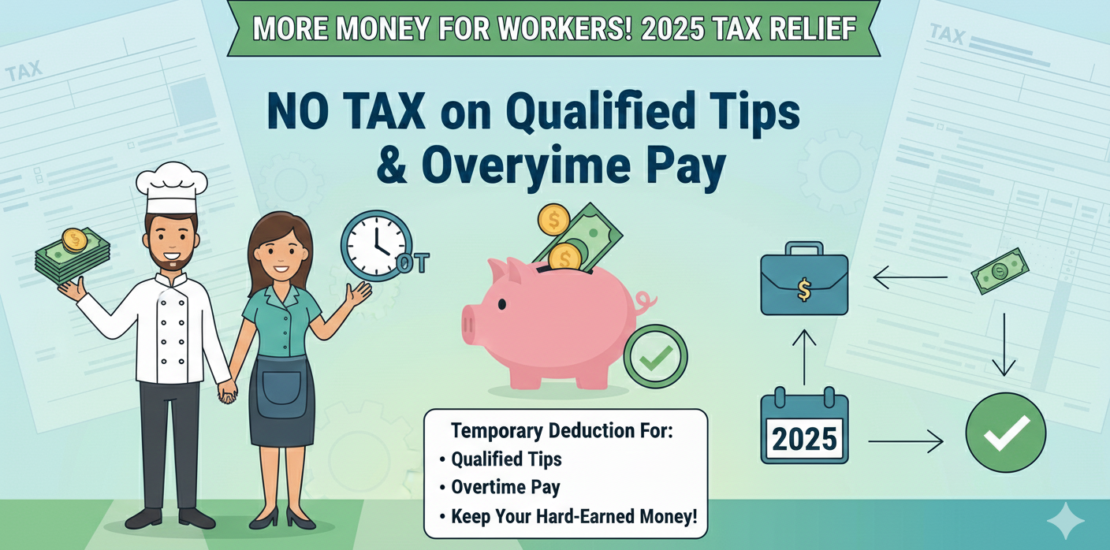

💼 Temporary Deduction for Qualified Tips & Overtime Pay (2025)

- December 23, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Marketing, Tax Credit, Tax News, Tax Preparation

No Comments

For tax year 2025, the Internal Revenue Service (IRS) has introduced a temporary deduction for certain workers receiving qualified tips and overtime pay, providing much-needed tax relief to hourly employees, service industry workers, and those earning extra through overtime. This deduction applies to income earned in 2025, filed during the 2026 tax season.

-

Child Tax Credit Increased to $2,200 per Child for Tax Year 2025

- December 23, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Marketing, Tax Credit, Tax News, Tax Preparation

-

2025 SALT Deduction Cap Boosted to $40,000 — What Taxpayers Need to Know

- December 22, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

-

Leveraging Tax Credits for Paid Leave: A Deep Dive into the American Rescue Plan Act of 2021

- February 26, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Marketing, Tax Credit, Tax News, Tax Preparation

The American Rescue Plan Act of 2021 introduced pivotal tax credits for paid leave, offering crucial support to individuals and businesses impacted by the ongoing challenges of the COVID-19 pandemic. This article focuses on the specific provisions related to self-employed individuals as outlined by the Internal Revenue Service (IRS). We explore eligibility criteria, qualified amounts, claiming procedures, and provide insights into maximizing these tax benefits.

-

SETC Tax Credit Overview: Navigating Tax Benefits For Self-Employed Taxi Services (Uber, Lyft, Curb)

- February 25, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Marketing, Tax Credit, Tax News, Tax Preparation

Self-employed individuals in the taxi services sector, including those driving for platforms like Uber, Lyft, and Curb, can unlock valuable tax benefits through the Self-Employment Tax Credit (SETC). This comprehensive guide delves into the intricacies of the SETC, outlining eligibility criteria, qualified amounts, and strategic approaches for maximizing tax savings.

-

Navigating Tax Season: Avoiding 10 Common Filing Pitfalls

- January 28, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Marketing, Tax Credit, Tax News

Uncover the essential guide to sidestepping tax filing pitfalls this season. Explore the Forbes article by Cicely Jones on “6 Tax Filing Mistakes To Avoid,” and empower yourself with knowledge to ensure a seamless tax-filing experience. From missed deadlines to the failure to seek professional help, this article dissects key errors to keep you on the path to financial success.

-

Refundable vs. Nonrefundable Tax Credits

- January 24, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

Tax credits can be refundable or nonrefundable. Refundable tax credits can reduce the amount of tax you owe and even increase your tax refund. Nonrefundable tax credits, on the other hand, can only reduce your tax liability to zero. This article explains the difference between refundable and nonrefundable tax credits.

-

Demystifying Tax Deductions, Tax Credits, And Tax Refunds

- January 23, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

Delve into the intricate world of income tax as we unravel the distinctions between tax deductions, tax credits, and tax refunds. Understand how each concept affects your financial landscape and discover the strategies to optimize your tax situation.

-

Navigating the IRS: $1 Billion in Penalty Taxes Waived as 2024 Tax Season Takes Off on Jan. 29

- January 17, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

In a significant move, the IRS has announced the waiver of $1 billion in penalty taxes, signaling a favorable start to the 2024 tax season scheduled to commence on January 29. This decision, explored in detail in a recent Fox Business article, brings relief to taxpayers facing penalties and introduces a more lenient approach for the upcoming tax year.

-

IRS Provides Initial Guidance to Employers Setting Up Emergency Savings Accounts for Their Employees

- January 15, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

The Internal Revenue Service (IRS) has issued initial guidance to help employers with implementation of pension-linked emergency savings accounts (PLESAs). Authorized under the SECURE 2.0 Act of 2022, PLESAs are individual accounts in defined contribution plans and are designed to permit and encourage employees to save for financial emergencies. Employers can offer PLESAs in plan years beginning after Dec. 31, 2023. This means that, in some cases, eligible employees could have begun contributing to a PLESA as early as Jan. 1, 2024. Subject to certain restrictions, matching contributions are made with respect to PLESA contributions at the same rate as contributions to the linked defined contribution plan.

-

How to Take Advantage of the Child Tax Credit in 2023

- January 15, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

The Child Tax Credit is a federal tax benefit that provides financial support for American taxpayers with children. For the 2023 tax year, taxpayers may be eligible for a credit of up to $2,000 — and $1,600 of that may be refundable. To qualify, taxpayers and their children must meet certain eligibility criteria that take into account the child’s age, as well as their relationship to the person claiming them. Taxpayers must also meet income thresholds to take full advantage of the benefit because the credit phases out for high earners.

-

Who Qualifies for the EV Tax Credit in 2023 and Beyond?

- January 13, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

The EV tax credit is a federal incentive that offers up to $7,500 for buying a new, qualified plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after. The credit is nonrefundable, which means it can only reduce your tax liability and not give you a refund. The credit amount depends on the battery capacity, the date of delivery, and the critical mineral and battery component requirements of the vehicle. The credit is also subject to income limits and phase-out rules based on your modified adjusted gross income (AGI) and the manufacturer’s sales volume. To claim the credit, you need to file Form 8936 with your tax return and attach the information provided by the seller at the time of sale

-

EV Tax Credit: How to Claim Up to $7,500 for Buying a New Clean Vehicle in 2023 or After

- January 12, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

The IRS offers a clean vehicle tax credit of up to $7,500 for buying a new, qualified plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after. The credit amount depends on the battery capacity, the date of delivery, and the critical mineral and battery component requirements of the vehicle. The credit is also subject to income limits and phase-out rules. To claim the credit, you need to file Form 8936 with your tax return and attach the information provided by the seller at the time of sale.

-

Max Out Contributions to a Health Savings Account

- January 12, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

A health savings account (HSA) is a tax-advantaged account that allows you to save money for medical expenses. You can contribute to an HSA if you have a high-deductible health plan (HDHP) and are not enrolled in Medicare. The maximum annual contribution limit is $3,850 for self-only coverage and $7,750 for family coverage in 2023.

-

How to Maximize Your Tax Refund: 10 Savvy Tips on Filing Status, Credits, Deductions, and More

- January 12, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

To optimize your tax situation, select the most beneficial filing status, such as comparing joint versus separate if you’re married. If eligible, utilize the earned income tax credit, which can reduce your tax liability and potentially result in a refund. Parents should consider the child tax credit, which can significantly decrease your tax bill if you meet the income and dependency criteria. Evaluate whether itemizing deductions or using the standard deduction is more advantageous for you. Contributing to a traditional IRA can help save for retirement while reducing taxable income. Lastly, maximize contributions to a health savings account if you have a high-deductible health plan, as these contributions are tax-deductible.

-

Unlock the Benefits of Solar Energy: From Tax Credits to Long-Term Saving – StritsTax

- May 9, 2023

- Posted by: strits

- Categories: Marketing, Tax Credit

We are professional Tax preparers. We prepare individual and business tax return. We help our client with Unemployment related questions and concerns.