-

Leveraging Tax Credits for Paid Leave: A Deep Dive into the American Rescue Plan Act of 2021

- February 26, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Marketing, Tax Credit, Tax News, Tax Preparation

No Comments

The American Rescue Plan Act of 2021 introduced pivotal tax credits for paid leave, offering crucial support to individuals and businesses impacted by the ongoing challenges of the COVID-19 pandemic. This article focuses on the specific provisions related to self-employed individuals as outlined by the Internal Revenue Service (IRS). We explore eligibility criteria, qualified amounts, claiming procedures, and provide insights into maximizing these tax benefits.

-

EV Tax Credit: How to Claim Up to $7,500 for Buying a New Clean Vehicle in 2023 or After

- January 12, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

The IRS offers a clean vehicle tax credit of up to $7,500 for buying a new, qualified plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after. The credit amount depends on the battery capacity, the date of delivery, and the critical mineral and battery component requirements of the vehicle. The credit is also subject to income limits and phase-out rules. To claim the credit, you need to file Form 8936 with your tax return and attach the information provided by the seller at the time of sale.

-

Unlock the Benefits of Solar Energy: From Tax Credits to Long-Term Saving – StritsTax

- May 9, 2023

- Posted by: strits

- Categories: Marketing, Tax Credit

-

Revolutionize Your Retail Business with SMSBlastNet.com: A Game Changer in SMS Marketing

- May 3, 2023

- Posted by: strits

- Category: Marketing

-

Who is Eligible for $600 check from the 2nd Stimulus Checks? Find out here

- December 23, 2020

- Posted by: strits

- Categories: Corona Virus (Covid-19), Economics

-

Unemployment extended with $300 – Congress agreed to a covid stimulus package

- December 21, 2020

- Posted by: strits

- Categories: Corona Virus (Covid-19), Unemployment

-

U.S. government has announced that it will suspend immigrant visa processing for citizens of 75 countries

- January 14, 2026

- Posted by: Mahfuj Ruzel

- Category: Uncategorized

According to Reuters and ABC News, the State Department is suspending processing for immigrant visas for nationals from the listed countries beginning Jan 21, 2026, while it reassesses procedures related to determining whether an applicant is likely to become a “public charge.”

-

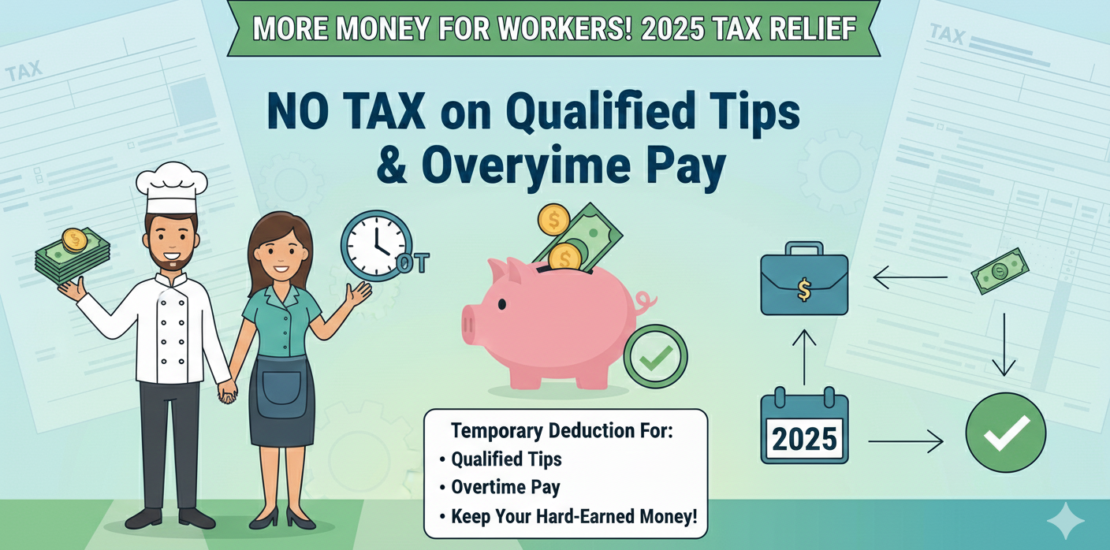

💼 Temporary Deduction for Qualified Tips & Overtime Pay (2025)

- December 23, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Marketing, Tax Credit, Tax News, Tax Preparation

For tax year 2025, the Internal Revenue Service (IRS) has introduced a temporary deduction for certain workers receiving qualified tips and overtime pay, providing much-needed tax relief to hourly employees, service industry workers, and those earning extra through overtime. This deduction applies to income earned in 2025, filed during the 2026 tax season.

-

Child Tax Credit Increased to $2,200 per Child for Tax Year 2025

- December 23, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Marketing, Tax Credit, Tax News, Tax Preparation

-

2025 SALT Deduction Cap Boosted to $40,000 — What Taxpayers Need to Know

- December 22, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

-

IRS Introduces New Car Loan Interest Deduction (2025–2028) – Full Guide

- December 22, 2025

- Posted by: Mahfuj Ruzel

- Category: Uncategorized

-

Updates for the Tax year 2025

- December 16, 2025

- Posted by: Mahfuj Ruzel

- Category: Tax News

📢 Major Updates for Tax Year 2025 (Filed in 2026)

-

Tax Break for Older American

- December 15, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax News, Tax Preparation

If you’re age 65 or older, the IRS has introduced a NEW additional deduction of up to $6,000 — and yes, it’s REAL and IRS-approved!

-

Republicans Cut $20 Billion from IRS Budget: Key Impacts and Controversy Explained

- December 28, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax News, Tax Preparation

In a move that has stirred political debate, Republican lawmakers successfully included a $20 billion cut in IRS funding as part of a larger bill to prevent a government shutdown. This strategic negotiation highlights the GOP’s priorities and ongoing tensions over government spending and federal agency powers. But what does this mean for taxpayers and federal operations?

-

Avoid IRS Penalties! Learn How to File Your BOI Report Before Dec 31, 2024

- November 23, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax News, Tax Preparation

The Beneficial Owner Information (BOI) report is a critical filing requirement introduced by the IRS and enforced under the Corporate Transparency Act. Designed to promote transparency and curb illegal activities like money laundering and tax evasion, the BOI report requires businesses to disclose detailed information about their beneficial owners.

-

DV-2026: Your Complete Guide to the Diversity Visa Lottery

- October 11, 2024

- Posted by: Mahfuj Ruzel

- Category: Uncategorized

The Diversity Visa (DV) program, commonly known as the Green Card Lottery, aims to increase diversity among immigrants in the United States. The DV-2026 program provides an opportunity for individuals from countries with low immigration rates to the U.S. to apply for a chance to receive a permanent resident visa. The official infographic by the U.S. Department of State guides applicants through the process, outlining important instructions and eligibility criteria. Understanding these details is crucial to improving your chances of successfully participating in the lottery.

-

প্রকল্প ২০২৫-এর Social Security এবং Medicare: তহবিলে কাটছাঁটের প্রস্তাবনা এবং এর প্রভাব

- August 15, 2024

- Posted by: Mahfuj Ruzel

- Categories: Economics, Finance & accounting, Tax News

Social Security এবং Medicare কর্মসূচিগুলি বহু দশক ধরে যুক্তরাষ্ট্রে সামাজিক সুরক্ষা প্রদান করে আসছে। Social Security কর্মসূচি বয়স্ক নাগরিকদের অবসরকালীন আয় প্রদান করে, যা তাদের দৈনন্দিন ব্যয় মেটাতে সহায়ক হয়। অপরদিকে, Medicare হলো একটি স্বাস্থ্যবিমা কর্মসূচি যা বয়স্ক এবং প্রতিবন্ধী ব্যক্তিদের স্বাস্থ্যসেবা অ্যাক্সেস নিশ্চিত করে। এই দুটি কর্মসূচিই যুক্তরাষ্ট্রের সমাজে অমূল্য অবদান রেখে চলেছে, এবং লক্ষ লক্ষ মানুষ এর উপর নির্ভরশীল।

-

প্রকল্প ২০২৫-এর ট্যাক্স নীতি: ধনীদের সুবিধা, মধ্যবিত্তের জন্য ঝুঁকি

- August 15, 2024

- Posted by: Mahfuj Ruzel

- Category: Uncategorized

প্রকল্প ২০২৫-এর অধীনে প্রস্তাবিত ট্যাক্স নীতির পরিবর্তনগুলো মূলত উচ্চ আয়ের ব্যক্তিদের জন্য ট্যাক্স হ্রাসের দিকে লক্ষ্য রাখে। এর মধ্যে কর্পোরেট ট্যাক্স কমানো, পুঁজির মুনাফার উপর ট্যাক্স হ্রাস এবং সম্পদশালীদের জন্য ট্যাক্স সুবিধা অন্তর্ভুক্ত রয়েছে। এই পরিবর্তনগুলির মাধ্যমে ধনীরা তাদের আয় বাড়াতে সক্ষম হবে, যখন মধ্যবিত্ত পরিবারগুলো আরও বেশি ট্যাক্স বোঝার মুখোমুখি হবে।

-

প্রকল্প ২০২৫: ওভারটাইম সুরক্ষা বাতিলে মধ্যবিত্তের বিপন্ন ভবিষ্যত

- August 15, 2024

- Posted by: Mahfuj Ruzel

- Categories: Economics, Finance & accounting, Tax News

ওভারটাইম সুরক্ষা হলো শ্রমিকদের একটি মৌলিক অধিকার যা তাদের অতিরিক্ত সময় কাজ করার জন্য ন্যায্য পারিশ্রমিক নিশ্চিত করে। এই সুরক্ষা শ্রমিকদেরকে প্রয়োজনীয় বিশ্রাম এবং ব্যক্তিগত সময়ের জন্য সুযোগ দেয় এবং তাদের অতিরিক্ত কাজের জন্য যথাযথ ক্ষতিপূরণ প্রদান করে। মধ্যবিত্ত পরিবারের জন্য, ওভারটাইম পারিশ্রমিক একটি গুরুত্বপূর্ণ আয় উৎস যা পরিবারের মৌলিক চাহিদাগুলি পূরণ করতে সাহায্য করে।

-

প্রকল্প ২০২৫: খাদ্য সহায়তা কর্মসূচি হ্রাস- মধ্যবিত্তের স্থিতিশীলতার জন্য হুমকি

- August 15, 2024

- Posted by: Mahfuj Ruzel

- Categories: Economics, Finance & accounting, Tax News

খাদ্য সহায়তা কর্মসূচি, যেমন সাপ্লিমেন্টাল নিউট্রিশন অ্যাসিস্ট্যান্স প্রোগ্রাম (SNAP), দীর্ঘদিন ধরে নিম্ন আয়ের এবং মধ্যবিত্ত পরিবারের জন্য পর্যাপ্ত পুষ্টি নিশ্চিত করতে সহায়ক হিসেবে কাজ করে আসছে। এই কর্মসূচিগুলি লক্ষ লক্ষ আমেরিকানদের আর্থিক সহায়তা প্রদান করে, যা খাদ্যের খরচ কমাতে এবং ক্ষুধা প্রতিরোধ করতে সহায়তা করে। তবে, হেরিটেজ ফাউন্ডেশন থেকে প্রস্তাবিত প্রকল্প ২০২৫ এর মধ্যে ফেডারেল খাদ্য সহায়তা কর্মসূচিতে উল্লেখযোগ্য হ্রাস করার প্রস্তাব রয়েছে।

-

ট্রাম্পের প্রকল্প ২০২৫: রক্ষণশীল এজেন্ডার বাস্তবায়ন কতটা সঠিক?

- August 13, 2024

- Posted by: Mahfuj Ruzel

- Categories: Economics, Finance & accounting, Tax News

প্রকল্প ২০২৫ হলো একটি বিস্তৃত এবং বহুমুখী পরিকল্পনা, যা রক্ষণশীল নীতিমালা এবং মূল্যবোধ প্রচারের মাধ্যমে মার্কিন সরকারকে পুনর্গঠন করতে চায়। এই প্রকল্পটি চারটি মূল স্তম্ভের উপর ভিত্তি করে তৈরি করা হয়েছে: একটি শক্তিশালী নীতি এজেন্ডা, প্রস্তুতকৃত কর্মীদের একটি পুল, ব্যাপক প্রশিক্ষণ কর্মসূচি, এবং নতুন প্রশাসনের প্রথম ছয় মাসের জন্য একটি ১৮০ দিনের প্লেবুক।

-

Republican Party’s Project 2025: Potential Risks of Cutting Food Assistance Programs

- August 13, 2024

- Posted by: Mahfuj Ruzel

- Categories: Economics, Finance & accounting, Tax News

Project 2025 advocates for a reduction in federal funding for food assistance programs, suggesting that these programs should be scaled back or devolved to state control. Proponents of this approach argue that it would reduce federal spending and encourage states to develop more efficient and targeted welfare programs. However, the reduction in federal support could lead to significant cuts in benefits and make it more difficult for families to access the food assistance they need.

-

Elimination of Overtime Protections: A Threat to the Middle Class

- August 12, 2024

- Posted by: Mahfuj Ruzel

- Category: Uncategorized

Project 2025 aims to eliminate or significantly reduce the scope of overtime pay protections. The rationale behind this proposal is rooted in a broader agenda of deregulation and cost-cutting for businesses. Proponents argue that reducing labor costs could enhance business profitability and job creation. However, this perspective overlooks the critical role that overtime pay plays in supporting middle-class families.

-

Understanding Project 2025: A Comprehensive Overview

- August 12, 2024

- Posted by: Mahfuj Ruzel

- Category: Uncategorized

Project 2025 is a comprehensive and multifaceted plan that aims to reshape the U.S. government by promoting conservative policies and values. The project is built on four key pillars: a robust policy agenda, a well-prepared pool of personnel, extensive training programs, and a 180-day playbook to guide the initial months of a new administration.

-

New York to Distribute $350 Million in Supplemental Payments

- August 1, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax News

New York State has announced a $350 million initiative to provide supplemental payments to residents in need, aiming to support moderate- and low-income households amid ongoing economic challenges. Here’s a detailed look at the eligibility criteria and what residents need to know.

- 1

- 2

We are professional Tax preparers. We prepare individual and business tax return. We help our client with Unemployment related questions and concerns.