Summary

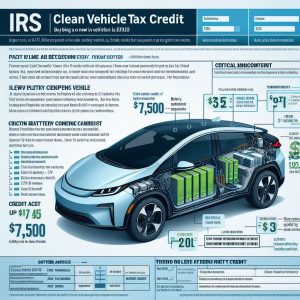

The IRS offers a clean vehicle tax credit of up to $7,500 for buying a new, qualified plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after. The credit amount depends on the battery capacity, the date of delivery, and the critical mineral and battery component requirements of the vehicle. The credit is also subject to income limits and phase-out rules. To claim the credit, you need to file Form 8936 with your tax return and attach the information provided by the seller at the time of sale.

Detail Explanation

If you are looking for a way to save money and reduce your environmental impact, buying a new clean vehicle may be a good option for you. Not only will you enjoy lower fuel and maintenance costs, but you may also qualify for a generous tax credit from the IRS.

The IRS offers a clean vehicle tax credit under Internal Revenue Code Section 30D for buying a new, qualified plug-in EV or FCV in 2023 or after. The credit is available to individuals and their businesses who use the vehicle for personal or business purposes. The credit is nonrefundable, which means you can only use it to offset your tax liability and not get a refund for any excess amount.

The amount of the credit depends on several factors, such as:

-

The battery capacity of the vehicle: The vehicle must have a battery capacity of at least 7 kilowatt hours (kWh) to qualify for the credit. The credit equals $2,500 plus $417 for each kWh of capacity over 5 kWh, up to a maximum of $7,500.

-

The date of delivery of the vehicle: The date you take possession of the vehicle determines the credit amount, regardless of the purchase date. For vehicles delivered from January 1 to April 17, 2023, the credit amount is based on the battery capacity only. For vehicles delivered from April 18, 2023 and after, the credit amount is also based on the critical mineral and battery component requirements of the vehicle.

-

The critical mineral and battery component requirements of the vehicle: For vehicles delivered from April 18, 2023 and after, the vehicle must meet certain requirements for the use of critical minerals and battery components to qualify for the full credit. Critical minerals are minerals that are essential for the economic and national security of the U.S. and have a high risk of supply disruption. Battery components are materials that are used to make the battery cells and modules of the vehicle. The vehicle must meet either or both of the following requirements:

- The vehicle must use at least 75% of critical minerals that are sourced from the U.S. or its allies, or recycled or reclaimed from end-of-life products. If the vehicle meets this requirement, it qualifies for a credit of $3,750.

- The vehicle must use at least 50% of battery components that are manufactured in the U.S. If the vehicle meets this requirement, it qualifies for a credit of $3,750.

If the vehicle meets both requirements, it qualifies for the full credit of $7,500. If the vehicle meets neither requirement, it does not qualify for any credit.

The credit is also subject to income limits and phase-out rules, which means you may not be able to claim the full credit if your income is too high or if the manufacturer sells too many vehicles. The income limits are:

- $300,000 for married couples filing jointly

- $225,000 for heads of households

- $150,000 for all other filers

You can use your modified adjusted gross income (AGI) from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in one of the two years, you can claim the credit.

The phase-out rules are:

- The credit begins to phase out for a manufacturer once it sells 200,000 qualified vehicles in the U.S.

- The phase-out period lasts for one year, starting from the second quarter after the quarter in which the manufacturer reaches the 200,000-vehicle limit.

- The credit is reduced by 50% in the first two quarters of the phase-out period, and by 75% in the last two quarters of the phase-out period.

- The credit is eliminated for vehicles delivered in the quarter after the phase-out period ends.

To claim the credit, you need to file Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit, with your tax return. You also need to attach the information provided by the seller at the time of sale, such as the vehicle identification number, the date of delivery, the battery capacity, and the critical mineral and battery component percentages. The seller must register online and report the same information to the IRS. If the seller fails to do so, your vehicle will not be eligible for the credit.

Key Points

- The IRS offers a clean vehicle tax credit of up to $7,500 for buying a new, qualified plug-in EV or FCV in 2023 or after.

- The credit amount depends on the battery capacity, the date of delivery, and the critical mineral and battery component requirements of the vehicle.

- The credit is also subject to income limits and phase-out rules.

- To claim the credit, you need to file Form 8936 with your tax return and attach the information provided by the seller at the time of sale.

Pros and Cons

| Pros | Cons |

|---|---|

| The credit can help you save money and reduce your tax liability. | The credit is nonrefundable, so you can’t get a refund for any excess amount. |

| The credit can encourage you to buy a more environmentally friendly vehicle. | The credit is subject to income limits and phase-out rules, so you may not be able to claim the full credit. |

| The credit can support the domestic production and recycling of critical minerals and battery components. | The credit may not be enough to offset the higher upfront cost of a clean vehicle. |

Tips for the Reader

- If you are interested in buying a new clean vehicle, make sure you check the eligibility criteria and the credit amount for your vehicle before you make the purchase. 🧐

- If you are eligible for the credit, make sure you keep the information provided by the seller at the time of sale and file Form 8936 with your tax return. 📝

- If you have any questions or doubts about the credit, contact the IRS or a tax professional for assistance. 🙋♂️