Mon - Fri: 10.00 AM - 10.00 PM

Saturday : 10.00 AM - 10.00 PM

Sunday : 11.00 AM - 10.00 PM

-

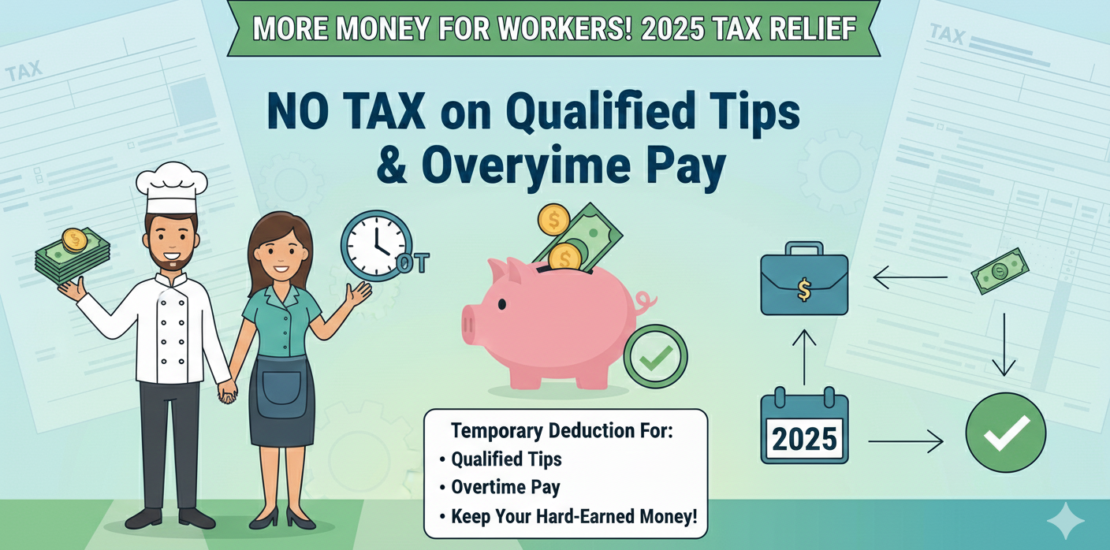

💼 Temporary Deduction for Qualified Tips & Overtime Pay (2025)

- December 23, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Marketing, Tax Credit, Tax News, Tax Preparation

No Comments

For tax year 2025, the Internal Revenue Service (IRS) has introduced a temporary deduction for certain workers receiving qualified tips and overtime pay, providing much-needed tax relief to hourly employees, service industry workers, and those earning extra through overtime. This deduction applies to income earned in 2025, filed during the 2026 tax season.

-

Child Tax Credit Increased to $2,200 per Child for Tax Year 2025

- December 23, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Marketing, Tax Credit, Tax News, Tax Preparation

-

2025 SALT Deduction Cap Boosted to $40,000 — What Taxpayers Need to Know

- December 22, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

-

IRS Introduces New Car Loan Interest Deduction (2025–2028) – Full Guide

- December 22, 2025

- Posted by: Mahfuj Ruzel

- Category: Uncategorized

-

Updates for the Tax year 2025

- December 16, 2025

- Posted by: Mahfuj Ruzel

- Category: Tax News

📢 Major Updates for Tax Year 2025 (Filed in 2026)

-

Tax Break for Older American

- December 15, 2025

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax News, Tax Preparation

If you’re age 65 or older, the IRS has introduced a NEW additional deduction of up to $6,000 — and yes, it’s REAL and IRS-approved!

How can we help you?

We are professional Tax preparers. We prepare individual and business tax return. We help our client with Unemployment related questions and concerns.