-

Who Qualifies for the EV Tax Credit in 2023 and Beyond?

- January 13, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

No Comments

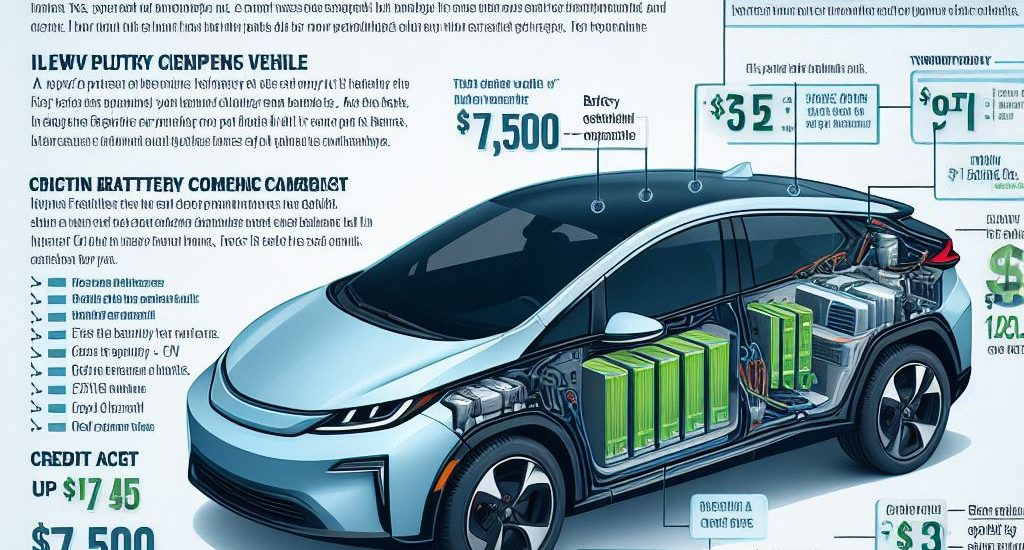

The EV tax credit is a federal incentive that offers up to $7,500 for buying a new, qualified plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after. The credit is nonrefundable, which means it can only reduce your tax liability and not give you a refund. The credit amount depends on the battery capacity, the date of delivery, and the critical mineral and battery component requirements of the vehicle. The credit is also subject to income limits and phase-out rules based on your modified adjusted gross income (AGI) and the manufacturer’s sales volume. To claim the credit, you need to file Form 8936 with your tax return and attach the information provided by the seller at the time of sale

-

EV Tax Credit: How to Claim Up to $7,500 for Buying a New Clean Vehicle in 2023 or After

- January 12, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

The IRS offers a clean vehicle tax credit of up to $7,500 for buying a new, qualified plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after. The credit amount depends on the battery capacity, the date of delivery, and the critical mineral and battery component requirements of the vehicle. The credit is also subject to income limits and phase-out rules. To claim the credit, you need to file Form 8936 with your tax return and attach the information provided by the seller at the time of sale.

-

Max Out Contributions to a Health Savings Account

- January 12, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

A health savings account (HSA) is a tax-advantaged account that allows you to save money for medical expenses. You can contribute to an HSA if you have a high-deductible health plan (HDHP) and are not enrolled in Medicare. The maximum annual contribution limit is $3,850 for self-only coverage and $7,750 for family coverage in 2023.

-

How to Maximize Your Tax Refund: 10 Savvy Tips on Filing Status, Credits, Deductions, and More

- January 12, 2024

- Posted by: Mahfuj Ruzel

- Categories: Finance & accounting, Tax Credit, Tax News, Tax Preparation

To optimize your tax situation, select the most beneficial filing status, such as comparing joint versus separate if you’re married. If eligible, utilize the earned income tax credit, which can reduce your tax liability and potentially result in a refund. Parents should consider the child tax credit, which can significantly decrease your tax bill if you meet the income and dependency criteria. Evaluate whether itemizing deductions or using the standard deduction is more advantageous for you. Contributing to a traditional IRA can help save for retirement while reducing taxable income. Lastly, maximize contributions to a health savings account if you have a high-deductible health plan, as these contributions are tax-deductible.

- 1

- 2

We are professional Tax preparers. We prepare individual and business tax return. We help our client with Unemployment related questions and concerns.